Life is cyclical – finance especially. One of the greatest challenges while pedaling through cycles is staying out of debt while managing through dry seasons. Having multiple streams of income will help. Also, keeping credit card debt out of the equation is huge – crucial – critical – choose whichever dramatic word to make the point. Credit card debt is aweful. Eliminating it is one of the best climbs in the world! Here’s some info we’ve found helpful:

DAVE RAMSEY APPROACH

How Can I Get Rid of My Debt Without Using Debt Reduction Programs?

We’re so glad you asked! You can ditch your debt yourself by following the 7 Baby Steps.

Step 1: Start an Emergency Fund

The first step in Dave Ramsey’s 7 step plan is, “Save $1,000 for Your Starter Emergency Fund.”

One of the main reasons people struggle with money is because necessary emergency expenses (like medical bills, car bills, or home repairs) come out of nowhere and drag you deeper and deeper into debt. But if you are preemptively prepared for these surprise expenses then they won’t take you off guard again.

So the very first thing you should do when getting your money in line is to get an emergency fund started. Save up an emergency fund in a separate bank account, until you have at least $1,000 in the account. This will be the start of the emergency fund that will keep sudden necessary expenses from plunging you into deep debts because you weren’t prepared.

Step 2: Focus on Debts

The second step in Dave Ramsey’s plan is to “Pay Off All Debt (Except the House) Using the Debt Snowball.”

The snowball method that Dave Ramsey refers to here means that you start by paying off small debts first and work your way up to the bigger debts. Debts can include paying off your car, credit card debts, and student loans.

First, make a giant list of all your debts, every single one, except for your mortgage if you have a house. Then, put your list of debts in order from the smallest debt amount to the largest. Then you go through knocking out each debt by eliminating the smallest debts first and working your way up to the largest debt last.

Step 3: Complete Your Emergency Fund

The third step is to “Save 3 to 6 Months of Expenses in a Fully Funded Emergency Fund.”

Now that you’ve gotten all your debts out of the way, it’s time to finish your emergency fund. You can use the same money you were using to pay off debts each month and put it toward your emergency fund until it has enough to cover 3 to 6 months’ worth of expenses and bills. Then you’ll really be prepared for anything.

Reasons to Have an Emergency Fund:

If you lose your job—you won’t have to worry because you’ll have enough to last you 6 months. This will give you the time you’ll need to find a new job.

If your car breaks down—you’ll be able to pay for the necessary repairs, the tow truck, or even for a new car in some cases.

Medical bills—don’t let your health and necessary medical bills keep you from staying afloat financially.

Home repairs—if something happens to your home you’ll be able to fix the problem rather than living with it.

Having an emergency fund is THE key to keeping you out of debt in the future. After getting yourself out of debt, an emergency fund is what will keep you from getting back into debt in the future.

Step 4: Save for Retirement

The fourth step in the Dave Ramsey plan is to, “Invest 15% of Your Household Income in Retirement.”

After your debts are gone and your emergency fund is taken care of, it’s time to start seeing to other important savings like retirement. Dave Ramsey recommends you take 15% of your gross monthly income and put it toward a retirement fund each month. To figure out how much you should be putting into your retirement fund each month, take your monthly income and multiply that number by 0.15.

Step 5: Save for College Funds

The fifth step to Dave Ramsey’s plan is to, “Save for Your Children’s College Fund.”

Avoiding student loan debts can be one of the biggest factors in staying out of debt as a young adult. If you can pay for your kid’s college tuition then you’ll ensure their financial security in the future, as they’ll better be able to stay out of debt.

Dave Ramsey recommends using either a 529 college savings plan or an education savings account (ESA). Talk to your bank or credit union about setting up these accounts for these specific purposes.

Step 6: Pay Off Your House

The next to last step in this 7 step plan is to, “Pay Off Your Home Early.”

Put all the extra monthly income you have into your mortgage so you can finish paying it off early. After this step, you will officially have no debts whatsoever! All of your earnings will go to you instead of getting drained away in large debts and payments.

Step 7: Build Wealth.

You’ll start by saving $1,000 for a starter emergency fund (Baby Step 1) and then move on to the big hitter (Baby Step 2): paying off all your debt (except the house) using the debt snowball method.

Finally, it is time to, “Build Wealth and Give.”

Congratulations! Once you’ve reached the 7th step in Dave Ramsey’s Baby Steps, you can start focusing on building your wealth. Don’t forget to keep and maintain those financial safety nets like a healthy emergency fund, retirement account, savings account, and college funds.

Now you are officially in charge of your money rather than it being in charge of you.

DEBT SNOWBALL

Step 1: List your debts from smallest to largest regardless of interest rate.

Step 2: Make minimum payments on all your debts except the smallest.

Step 3: Pay as much as possible on your smallest debt.

Step 4: Repeat until each debt is paid in full.

Now, before you start arguing about the interest rates, hear us out. If your largest debt has the largest interest rate, it’s going to be a long time before you start to see a dent in that crazy balance of yours. But when you stick to the plan (without worrying about interest rates), you’re going to be jumping up and down when you pay off that smallest debt super quick. That excitement is what’s going to motivate you to keep working hard—all the way to that debt-free finish line.

With this debt reduction strategy, you pay off your debts from smallest to largest, paying minimum payments on everything but the little one. You throw all you’ve got at that smallest balance until it’s gone. When it’s paid in full, take the amount you were paying on it and throw it at the next-smallest debt. Remember: The more you pay off, the more money you’ll have to pay off debt—for good.

The debt snowball method works because it’s not just a fancy math problem. It’s about real behavior change.

If you’re trying to claw your way out of a financial crisis and don’t know where to begin, a financial coach may be what you need. Our coaches can guide, equip and encourage you to make the best financial decisions for your future.

How to Find Real Debt Relief

Want real debt relief? Who doesn’t? The only way to find true debt relief is by choosing—right now—to stop taking on more debt . . . and then doing everything in your power to pay it off.

Listen, debt reduction services might sound good on the surface, but they only keep you in debt—and take your money while they’re at it. Debt reduction services only deal with the symptoms of a debt problem, not the cause.

That’s why it’s so important to follow those Baby Steps. It’s the debt reduction strategy that actually works—you just have to stay with it. But it’s not just a quick fix (nothing ever is). You’ve got to choose to be intentional, focused and willing to work hard! Your progress will only move at the speed of your motivation.

You definitely don’t need to pay for a debt reduction service to do what you can do on your own. Skip the quick-fix scams and focus your energy on a plan that actually works.

MORE AT www.ramseysolutions.com/dave-ramsey-7-baby-steps

=============================================

At first, the credit card payments didn’t seem like a big deal. A few bucks here, a few bucks there. You didn’t pay attention to the interest or the balance. That is, until you added up the other bills: Student loan payments. An unexpected trip to the emergency room. A new roof. Before you know it, you’re out of money and sitting on top of a mountain of debt. But there are still bills to pay and not enough money to cover them.

So what do you do when you can’t pay your bills?

1. Cover your Four Walls.

When creditors are calling (emailing, texting, or sending snail mail), it’s easy to get bullied. Most of the time, they’ll try to convince you that paying them is more important than keeping the lights on.

Listen closely: The most important thing you can do is take care of your Four Walls first—and in this order:

- Food

- Utilities

- Shelter

- Transportation

Before you spend even one more dime toward debt, make sure to take care of you and your family. That means you need food in the fridge, lights and running water, a roof over your head, and a way to get to and from work every day.

2. Get on a budget.

We know, you’re probably thinking, What’s the point of a budget when I have no money?

You can pay off debt faster! Get started with a FREE trial of Ramsey+.

Give us the benefit of the doubt here. When you make a budget, you’re taking inventory of the money you have coming in and telling it exactly where to go. This is extremely helpful when you’re wondering how to make ends meet.

With a zero-based budget and more debt than income, you might see a lot of red for a little while. But don’t worry. Stick to your budget, cut out the extra spending, and you’ll see it balance to that beautiful zero in no time.

3. Get (and stay) current on your bills.

That means you need some extra cash—and fast! Whether that means you get a second or third job, start a side hustle making cupcakes, or sell that fancy wedding china you’ve never taken out of the box.

Don’t worry—there’s plenty of things you can do to make ends meet:

- Sell your vehicle for a cheap-but-reliable used car instead.

- Have the biggest yard sale ever.

- Don’t step foot inside of a restaurant unless you work there.

- Get a second job.

- Consider downsizing your home so you can make more manageable payments.

- Switch your cell phone plan to a pay-as-you-go service—and use your phone only for emergencies.

- Get a roommate and share the living expenses.

- And no matter if it’s $5 or $500, any extra money you make should go toward past-due bills.

You always have options!

4. Give your creditors their fair share.

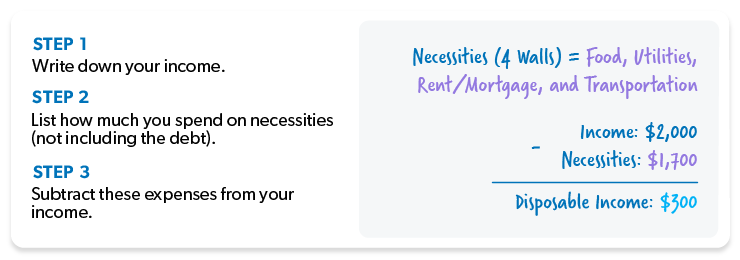

When you can’t pay your bills, you need a plan. And when it comes to dealing with creditors, we like to use what’s called “pro rata” . . . or “fair share.” This means you’ll give each of your creditors their fair share of the money you have left after you’ve paid for the essentials (like the Four Walls). Here’s an example of how it works:

In this case, you have $300 left over to pay your creditors. This is your disposable income.

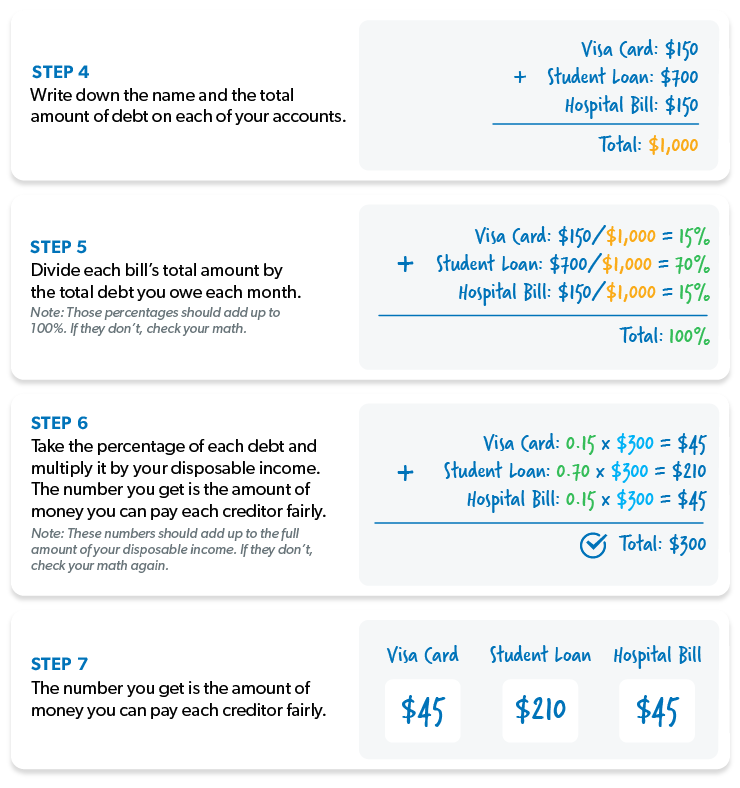

Once you know how much money you can spend on debt payments, you need to figure out pro rata. This part is a little more complicated, but stay with us. Here’s how you calculate it:

Remember, the pro rata plan is only a short-term solution. It just gives you enough breathing room to make changes for the better.

But here’s the thing: You won’t get out of debt this way. However, making monthly payments to each creditor goes a long way in the long run.

5. Send payments with a letter.

Now that you’ve decided who to pay (and how much to pay them), it’s time to send your payments. Make copies of your math, including your income, expenses, disposable income, and the calculations you made to give every creditor their fair share. Don’t forget to include this letter with every bill, every single month.

Those creditors won’t like getting less than the minimum payment, but if you keep sending checks every month, they’ll probably keep cashing them.

This doesn’t mean they’ll stop calling and bullying you into giving them more money, but don’t let that steer you off course. You don’t want to get so rattled that you agree to something that will shoot you and your family in the foot when it’s time to buy groceries.

And never, ever give a creditor access to your bank account for automatic withdrawal every month. They’ll clean you out—even if they say they won’t.

Now What?

It’s time to move away from that paralyzing fear and start getting mad. Listen: Debt has got you chained to your past, so it’s time to start attacking it with everything you’ve got.

Give your debt the kick in the pants it needs to get out—and stay out—of your life. How? By changing your behavior (and your attitude). We’re guessing that by now, you’re sick and tired of living paycheck to paycheck.

That’s where the debt snowball comes in handy:

Step 1: List your debts smallest to largest, regardless of interest rate. Pay minimum payments on everything but the little one.

Step 2: Attack the smallest debt with a vengeance. Once that debt is gone, take that payment (and any extra money you can squeeze out of the budget) and apply it to the second-smallest debt while continuing to make minimum payments on the rest.

Step 3: Once that debt is gone, take its payment, and apply it to the next-smallest debt. The more you pay off, the more your freed-up money grows and gets thrown onto the next debt—like a snowball rolling downhill.

Repeat this method as you plow your way through debt. Pretty soon, you’ll be debt-free and ready to start living the life debt stole from you.

Remember: You don’t ever want to go there again, so do whatever it takes to say hasta la vista to debt for good! Just imagine the life you’ll be living when you’re debt free.